Punish the Wealthy, Cancel Trump’s Achievements

Naresh777 / Shutterstock.com Drop of Light / Shutterstock.com

“Trickle-down economics has never worked.”

The Biden administration declared that when the rich became richer, the benefits never trickled down to everyone else. The administration denied the former Trump administration’s tax cuts and small-government movement, instead embracing big government that takes care of people’s lives in exchange for higher taxes and limited freedom.

During his first 100 days, President Joe Biden drafted a roughly $6 trillion government spending plan. Only 5% of government spending will be used for infrastructure such as bridges and roads. The majority will go to climate change efforts and teachers’ unions. It is as if the Democratic Party is making these investments to gain more votes, and even worse, the enormous spending plan will be paid for through a tax hike.

It is questionable whether the economic policies of the previous administration should be buried as a failure. We spoke with Dr. Arthur B. Laffer, a former economic advisor for the Trump administration, regarding the Biden administration’s drastic policy shift.

* * * * *

Trump Administration’s Tax Cuts Brought Prosperity

Cho: In April’s address to the joint session of Congress, President Biden said that Trump’s “big tax cut of 2017 was supposed to pay for itself and generate vast economic growth…Instead, it added $2 trillion to the deficit.” Austan Goolsbee, an economic advisor for the Biden administration, said on CNBC’s ‘Squawk Box’ that the tax cut of 2017 remains the most unpopular tax cut in the history of American polling”. How do you respond?

Dr. Laffer: Biden wants to reverse President Trump’s tax cuts. I want to show you a chart that depicts the truth.

Trump’s Tax Cuts Dropped Black Unemployment to Record Low

Dr. Laffer: The first chart shows real GDP growth for the U.S. and the eurozone two years before and after the Tax Cuts and Jobs Act (TCJA).

You can see that the U.S. and the eurozone grew at almost exactly the same rates by quarter in the two years preceding the TCJA. In the two years following the TCJA, the European Union had a big downturn in growth rates and the U.S. did not have a big downturn in growth rates. In other words, our growth relative to the rest of the world increased dramatically right on the day of the TCJA. Where would you rather live, the U.S. or the European Union?

Median household income was $68,703 in 2019, setting a new record and surpassing the Obama administration’s highest record by approximately $4,900.

Black unemployment also fell to a record low of 5.2%. The U.S. poverty rate also fell to 10.5% during the Trump administration, the lowest it has ever been in recorded history.

Biden says tax revenues went down, but he is not telling the truth. If you look at these bar charts, it shows that real tax revenues for the federal, state and local governments combined went up following the TCJA. Both federal and local governments benefitted. Not only did tax revenues go up, they went up at a faster rate than they did during the two years prior to the TCJA.

In terms of corporate taxes, corporate tax revenues as a percentage of GDP in OECD countries had an upward trend in the last 40 years while the average corporate tax rate of these 37 OECD countries kept falling. In other words, the level of tax rate and the amount of tax revenue are inversely proportional to each other.

The Trump administration took the highest corporate tax rate in the world of 38.92% down to 25.84% with the TCJA, but Biden wants to raise the corporate tax rate to 32.37%, which would be the highest tax rate in the OECD. You know what the incentives will do with that.

‘They Can’t Socialize America if We Tell the Truth’

Cho: There are concerns of impending inflation due to huge government spending. Could it cause inflation like in the 1970s?

Dr. Laffer: It could.

But there is more to government spending.

The government is having a party on the capital stock of the U.S. The Ant and the Grasshopper story is the perfect story here. We’re the grasshopper. People are wanting to eat now and have nothing later.

There are people desperate out there, they say, ‘Just give me something,’ and the government gives them something, even if it’s wrong.

They don’t primarily care about the prosperity of the country. They primarily care about the political advantages given to them by saying something that is untrue.

Do you think the poor, the minorities, the disenfranchised, the undereducated, the weak and the helpless are going to be helped by deficit spending? No, they are not. The people who will be helped are the smart people who understand what’s going on and put their money aside in different forms.

You’re going to see a huge exacerbation of income inequality in the U.S. and the absolute desperation of the poor, the minorities, the disenfranchised in this country.

These numbers are exact official numbers from the Congressional Budget Office (CBO). There are no disputes on those numbers at all, and [Biden] is telling something that is not true. Whether he knows it is not true or not, I don’t know, but someone there does. I would never accuse a president of lying, but he is not telling the truth.

I was on CNBC’s Squawk Box with Austan Goolsbee, and he said the same thing Biden said. And the host of the show, Joe Kernen, said, ‘Austin, stop. You’re lying,’ and he quoted my numbers. They can’t win on the truth. They can’t socialize America if they tell the truth.

What’s Wrong With a Tax Hike?

Cho: Can I ask you what is most problematic about a tax hike?

Dr. Laffer: From the standpoint of economics, the most problematic tax hike is on the highest tax rate, which is usually on the highest income earners. When you cut the tax rate, people are motivated to work, and the largest positive effect on incentives are created by lowering the highest tax rate. Tax cuts under John F. Kennedy were good examples.

Kennedy cut the highest tax rate from 91% to 70%. He also cut the lowest tax rate from 20% to 14%. I am just going to talk about the highest and the lowest, and there are a lot of taxes in between that I am not going to talk about. By dropping the rate from 91% to 70%, that is a 21-percentage point drop in the tax rate. In percentage terms, the percent cut in that rate, which is the static revenue loss, was 21 divided by 91 — a 23% cut in the top tax rate.

By dropping the tax rate from 20% to 14%, that’s a 6-percentage point drop in the tax rate. They had been paying 20%, so that is a 30% drop from the initial tax rate of 20% — 6 divided by 20. So, Kennedy cut the highest tax rate by 21% and the lowest tax rate by 30%.

Let’s look at it in terms of incentives. In the top tax bracket at 91%, the person’s incentive for earning one dollar was nine cents. If he earned one dollar, he paid 91 cents in taxes, and he was allowed to keep nine cents. That is his incentive. After the tax cut, he pays only 70 cents in taxes for a dollar earned, so his incentive has gone up from nine cents on the dollar to 30 cents on the dollar.

His incentive before the tax cut was nine cents. His incentive after the tax cut was 30 cents. That is a 233% increase in incentives for a 23% cut in the tax rate. When you divide 233 by 23, that has a benefit-cost ratio of 10-to-1 at the highest rate.

Now, look at a person at the 20% bracket. Instead of paying 20 cents on the dollar, that person now pays only 14 cents on the dollar. That’s a 7.5% increase in incentives from 80 cents to 86 cents. As we have already discussed, it is a 30% static revenue cut. If you divide the two, the benefit-cost ratio for the lowest income is 1-to-4. Recall that the benefit-cost ratio for the rich is 10-to-1.

When you cut the highest marginal tax rate, the benefit-cost ratio becomes much higher for high-income earners compared to low-income earners. (Note: The ‘benefit’ is the percentage increase in incentives after the tax cut. The ‘cost’ is the percentage decrease in tax rates.) Thus, we have to lower the highest tax rate because the increase in incentives is much greater, the higher the tax rate.

Number two, rich people have available to them all sorts of tax shelters. They can change the location of their income. They can change the timing of their income. They can change the volume and the composition of their income. They have the money to hire lawyers, accountants, deferred income specialists and politicians. There are just thousands of ways they can do it. Therefore, these people are much more able to not report their income. The lowest income earners don’t have the money to hire lawyers or accountants.

Number three is a subtle argument but it’s true. I’m sure it’s true in Japan too, but let me tell you what it is here.

When you file your tax return, everyone pays the lowest tax rate. The first $20,000 of income for rich people and poor people all get taxed at the same low rate. Then at the next $20,000, they raise that rate, and they all pay a percentage on that income. It goes up all the way.

For the highest income earners, their marginal tax rate, which is the incentive rate, is the highest tax rate. All the lower tax rates are what we call inframarginal, and they don’t affect behavior right now. When you look at the lowest tax bracket, there’s a very small percentage of people who are paying that tax rate as a marginal tax rate. For every tax bracket you go up, more people are paying that bracket as a marginal tax rate. When you get to the highest tax bracket, 100% of people in that bracket are paying it at a marginal rate.

Therefore, when you cut tax rates on the rich, everyone in that bracket is incentivized to produce more and to shelter less.

* * * * *

Will Big Government Turn to Communism?

President Joe Biden, who shifted the tide to “big government,” claims that the Trump administration’s tax cuts did not create economic growth.

This is a mere propaganda, however. Dr. Arthur Laffer’s data deftly exposed Mr. Biden’s false claim.

Donald Trump’s tax cuts increased people’s incentives to work and reduced their dependence on welfare. People regained the joy of working, an economic boom commenced and the minority unemployment rate fell to a record low. A rising tide lifts all boats.

Meanwhile, the Obama administration pushed forward with the growth of social welfare programs. As a result, 36.4 million people, or about one in 4.5 people of the working-age population, became dependent on food stamps. The Biden administration will accelerate Mr. Obama’s effort and create a welfare state.

A nation’s role is not to increase dependence on welfare.

An important role of politicians is to provide people the opportunity to raise their self-esteem through work and be filled with joy of becoming closer to God.

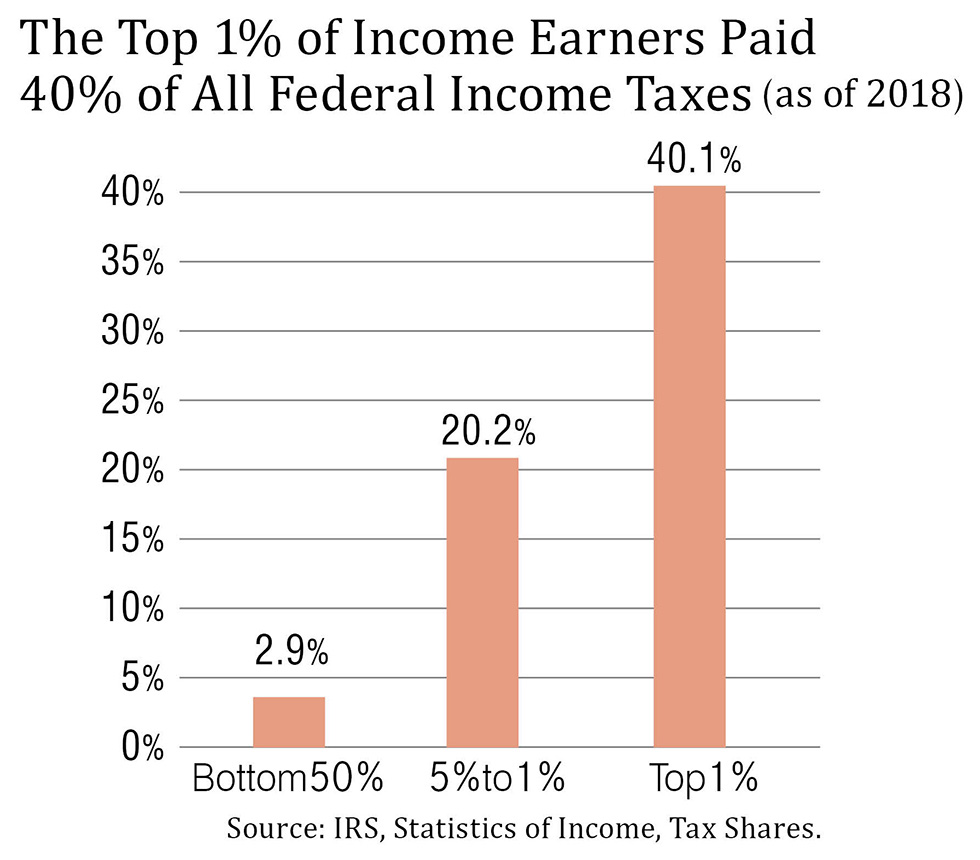

Top 1% Pays 40% of Income Taxes

So why raise taxes?

In a nutshell, it is for “public punishment.” If the Biden administration appears to be punishing big corporations and the wealthy, the Democratic Party will seem kinder to the poor — in this way, they can win the hearts of ordinary American citizens.

In the Soviet Union, wealthy farmers, or kulaks, were subjected to severe punishment such as forced labor, and a large number of people died.

The strongly left-leaning Biden administration is hostile to the top 1% of income earners, just as the Stalin was to the kulaks. After the Reagan administration’s tax cuts, however, the burden rate of federal income tax revenue of the top 1% (1.3 million people) continued to rise, reaching approximately 40% as of 2018 (see figure below). The bottom 50% accounts for a mere 2.9%. Mr. Biden emphasizes that the top 1% should pay a fair burden, but the reality is, they already do.

The Biden administration does not convey such facts to the American public, and it pushes for economic policies that are hostile to wealthy people and large corporations. Mr. Biden’s economic policies are reminiscent of the Soviet Union’s communist revolution, in which wealthy farmers were robbed of their rights and killed.

It is a communist practice to create enemies and bring the country into a class struggle. Perhaps Mr. Biden is the one who is fueling division rather than unity. A communist revolution is underway in the U.S.