The Future of the Chinese Yuan: An Interview with Commentator and China Watcher Masahiro Miyazaki

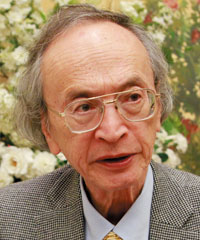

Masahiro Miyazaki

Born 1946, in Ishikawa prefecture. Entered Waseda University but left before obtaining a degree. After having worked as a publication editor, he became a critic in the press in 1983. Since, he has established himself as a renowned critic and reporter on the behind-the-scenes workings of political science and economics, known for his unique information gathering and analyses. As a China watcher, he has travelled through all 33 provincial regions of China on foot. He has written many books such as “The World that has given up on China and South Korea”. In May 2015, he published “The Dreadful End for the AIIB”.

As China asserts its presence in the world economy, what are the true intentions behind the AIIB (Asian Infrastructure Investment Bank)?

In the featured article “In 2023, Xi Jinping Will Rule The World” of the July issue of The Liberty magazine now on sale in bookstores around Japan, we interviewed Masahiro Miyazaki, a renowned China watcher who has travelled through all 33 provincial regions of China. This article presents in two sections, inside information on China that could not be published earlier due to space restrictions. Part 1 is on the strength of the Chinese Yuan.

What China Is Doing To Achieve Their Aim Of Economic Hegemony

Q. What strategies do you think China will employ in order to strengthen their economic hegemony?

Miyazaki (M): Up until now, China has been expanding the influence of the Chinese Yuan. For instance, Laos, Cambodia, and northern Myanmar are all regions using the Chinese Yuan. Even in Japan and Taiwan, converting currency to Yuan can easily be done, and European duty-free shops accept payments in Chinese Yuan. Another thing China is doing is to increase the countries associated with the Central bank currency swap, which allows for local currencies to be used for payments on trade up to a particular amount where USD are usually required.

Q. Does this mean that China is aiming to make settlements of strategic resources, such as oil, with the Chinese Yuan?

M: That may be their ultimate goal, but they won’t be undertaking such large-scale transactions for now. They are, however, doing a lot of trade with Russia. China has much to offer Russia, and China needs to buy weaponry from Russia, so a currency swap is viable.

On the other hand, Brazil for instance, has had a sudden decrease in demand for iron ore, so they have nothing to buy from China. They are buying instant noodles and clothing from China, but they need to protect their own textile industry, so they can only import so much. In this case, the amount of trade doesn’t increase, so it doesn’t contribute to the expansion of the Yuan’s influence.

The Chinese Yuan Will Collapse If It Adopts a Floating Exchange Rate

Q. China is currently pegging the Yuan to a basket of currencies instead of using a floating exchange rate. Do you think China will convert to a floating exchange rate system any time soon?

M: China wants the Yuan to become accepted as a major currency, and to achieve this, they want the Yuan to be included in the Special Drawing Rights, which is maintained by the International Monetary Fund (IMF) and consists of USD, Pounds and Euros. But the IMF prerequisite for the Yuan to be considered is that it has to use a floating exchange rate system. If it does so, however, the Yuan will most likely collapse.

The strength of a currency is determined by the confidence that the world has toward that country, and this is decided by the country’s current account, government bond interest rate, and political stability. Currently, China’s current account is a surplus and the government seems to be politically stable. But the interest on 10-year government bonds is in excess of 3.6%, which shows the lack of confidence in the currency.

In addition, although China claims to have a currency basket system, in reality, the Yuan is pegged to the USD; so when the USD rises, so does the Yuan. That is why, although the true values of the Yuan is actually around 12 Japanese yen, the present exchange rate is 21 Japanese yen, inflating it by 75%. In this sort of situation, the Yuan will collapse if it converts to a floating exchange rate system.

A merit of the strong Yuan is that import costs of resources such as crude oil become cheaper. This also means that the strong Yuan is disadvantageous for exports, so China is resorting to artificially low-priced sales and “dumping” policies to increase exports.