Bring Back Capitalism With ‘Small Government’

As Mr. Lingle said, if too much money is printed, prices will rise unless there is production commensurate with the amount of money produced. Under Abenomics, “extraordinary relaxation” was put into place. The amount of currency, which was 500 trillion yen in 2012, has doubled by 2021.

The situation was exacerbated by the depreciation of the yen. The yen exchange rate, which was around 115 yen to the dollar on Feb. 22, 2022, is currently 147 yen (as of Sept. 19), a more than 20 percent increase in depreciation, which has led to higher import prices.

Yet, the government has no qualms about distributing even more money as a “countermeasure against high prices”—this is pouring fuel on the fire by increasing the money supply. If prices double, a beef bowl that costs 500 yen will cost 1,000 yen. This is a policy that will plunge the entire nation into the abyss. It is time for people to realize that money does not equal wealth.

Moreover, the government’s extravagant spending will be paid for in the form of so-called “inflation taxes.” An inflation tax means that while the private sector will be able to buy fewer things as prices rise and the value of money falls, the government’s burden of repaying their debt will be substantially lightened.

This is a big advantage for governments that have huge responsibilities. The government may be thinking that reducing the value of the currency through inflation and therefore reducing debt is a promising path for them.

Weak Yen Makes It Hard to Make Ends Meet

Then yen has weakened due to the difference in interest rates between the U.S. and Japan, and soaring import prices are putting pressure on people’s daily lives. In that case, the government should raise interest rates in line with the U.S., but this would increase the government’s interest payment burden, which is virtually forbidden in Japan with its enormous government debt. The central bank is now unable to conduct monetary policy in a crisis, and its job of controlling inflation has been compromised by the growing government debt.

This is largely due to a series of Keynesian policies that were wielded during peacetime, even though they were only meant to be used during times of emergency.

Keynes’s theory, which was devised as a countermeasure in times of depression, is extremely compatible with politicians’ desire for power. Handing out money is considered an “achievement” which gives you votes. Politicians’ greed has undermined “healthy currency” creating an economic bubble and making the citizens poor, but if they can help with the citizens’ immediate needs, then they can play out the role of a benevolent politician.

The Bank of Japan had a hand in this. By purchasing government bonds, the Bank of Japan lowered long-term interest rates, allowing the government to pursue low interest rates to fund its fiscal stimulus, thereby causing the government to lose fiscal discipline. This increased the supply of money to the market, which lowered the value of the yen and escalated inflation. The depreciation of the yen has exposed the controversies of the Bank of Japan.

When compared to a public company, the Japanese government is operating its business in a debt-based manner, with its continued increase in debt (expenditures) despite its lack of profits (revenue). It is natural to question whether such a nation can continue to issue a credible currency.

Spending Nations And Social Welfare States Will Collapse

Then what should be the antidote? It is to become a truly libertarian, capitalist state.

Only when the private sector is incentivized to work hard will the economy move towards growth. It is necessary to create a good cycle of diligent work, saving money and investing, and the government’s role should be a mere facilitator who increases the incentives for people to work.

Tax cuts are essential to this, and as Grover Norquist, President of Americans for Tax Reform ( https://eng.the-liberty.com/2023/9456/ ), has worked hard to do, the key is to build national momentum for economic growth from tax cuts and force politicians to keep their promises.

In the U.S., there is a race among the states to cut taxes in an attempt to ease the pain of rising prices.

The most prominent is the elimination of the income tax and the reduction of the tax rate. In a move to increase take-home pay, more and more people are moving to states that either have no or lower income taxes.

Another is a shift away from becoming a welfare state by reducing government spending and restoring fiscal discipline.

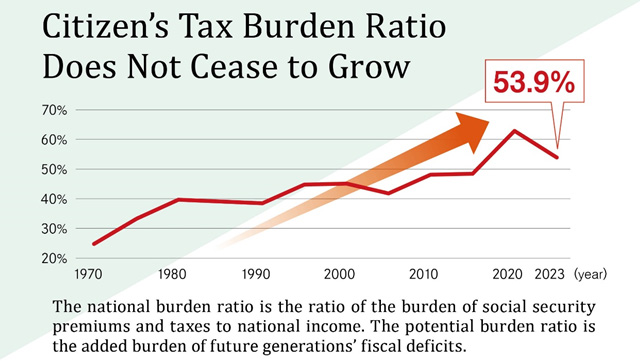

The potential national burden ratio including the future government debt repayment burden for FY23 (April 2023 to March 2024) is 53.9 percent, a number surpassing 50 percent (see below).

Economist Kenya Kura calculated the potential national burden ratio for Japan with its aging population after 2040 to be 71 percent (*1).

Such a society is blatantly socialist, and the vitality of the society will be deprived of by a few elites and the people enslaved. Without private investment, citizens will lose an opportunity to innovate, and the nation will gradually decline.

People must understand that wealth comes from the private sector, not the public. We must know that the path to development and prosperity is to reduce the national burden ratio of citizens and create more profitable corporations.

A prediction has been made for the future: “Governments that engage in extravagant spending and nations that coddle its citizens with social welfare packages producing a myriad of lazy citizens… will all be pressured to collapse” (*2).

What exactly should be done to prevent this?

We interviewed an expert who is leading the way to realizing “small government” in the U.S. ( https://eng.the-liberty.com/2023/9456/ ).