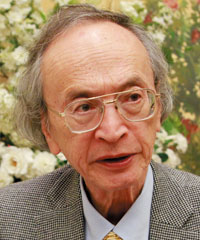

The Illusion of China’s GDP. An Interview with Commentator and China Watcher Masahiro Miyazaki

Masahiro Miyazaki

Born 1946, in Ishikawa prefecture. Entered Waseda University but left before obtaining a degree. After having worked as a publication editor, he became a critic in the press in 1983. Since, he has established himself as a renowned critic and reporter on the behind-the-scenes workings of political science and economics, known for his unique information gathering and analyses. As a China watcher, he has travelled through all 33 provincial regions of China on foot. He has written many books such as “The World that has given up on China and South Korea”. In May 2015, he published “The Dreadful End for the AIIB”.

As China asserts its presence in the world economy, what are the true intensions behind the AIIB (Asian Infrastructure Investment Bank)?

In the featured article “In 2023, Xi Jinping Will Rule The World” of the July issue of The Liberty magazine now on sale in bookstore around Japan, we interviewed Masahiro Miyazaki, a renowned China watcher who has travelled through all 33 provincial regions of China. This article presents in two sections, inside information on China that could not be published earlier due to space restrictions. Part 2 is on the China’s GDP.

China’s GDP is a Fabrication

Q. China’s electricity consumption has recently been dropping, but their GDP reveals a 7% economic growth rate. Why is this so?

M: That is just some creative writing. No one trusts China’s GDP report. China’s local governments are padding the numbers, and their method of gathering statistics is questionable. From my calculations, China’s GDP would either be the same, or only slightly higher than Japan’s current GDP.

For instance, GDP usually consists of investments including residential housing consumption, private infrastructure investments, fiscal expenditure, and trade surplus. For China, property investment is 12% of their GDP. If we include all infrastructure construction, just the investment would amount to 48% of the GDP. This means that if they lose this investment, Chinese economy will fall flat.

They are also cheating the consumption numbers. Countries such as America and Japan use the POS (Point of Sale) system to gather statistics at department stores and supermarkets, so there is no way they can present deceptive consumption data. For China, however, we cannot tell.

Next is investment in private infrastructure. The companies in China that are involved in facility investment, invest twice as much as their productive capacity. Ironwork and automotive factories have made too many products, and consequently there are many apartments with empty rooms. This is also the case with the textile industry. It is in a state of overinvestment, so there is the danger of sudden collapse. The reason why China can still hold on is because of inflow of overseas investments.

At the top of the list of countries that are being deceived by China are Germany, England and South Korea. With Germany, there is a plan to expand their Volkswagen factories and to increase the production rate in China to 5 million vehicles per annum by 2018. Similarly, Korean automobile productions in China will amount to 1.8 million vehicles per annum by 2018. All of this, with a looming reality that only 24 million of China’s current production of 50 million vehicles per annum are being sold. Having said that, 24 million is more than America, and is still a huge number.

China Hardly Has Any Foreign Currency Left

Q. You said that China is supporting their GDP through investment, but are they doing this by using their capital reserve (mostly USD) that they have saved up?

M: No, they are investments from overseas. In the past 20 years, there have been investments of an average $100 billion yearly; a total of 2 trillion USD. In addition to this there are indirect investments of stocks and real estate. There is a lot of this money. But hot money such as these stocks, have a tendency to be retracted. China’s foreign currency reserves are officially announced to be around $3.8 trillion so it may seem like the Chinese economy is well off, but this is actually a paper tiger.

Q. So what will happen if overseas investors withdraw?

M: It will be the end [for China]. Not to mention that some investigations have revealed that there has been around $3.78 trillion that has been illegally smuggled overseas. If we subtract their officially announced $3.8 trillion in foreign currency reserves, they will be left with a mere $20 billion.

On the other hand, China owns $1.2 trillion worth of U.S. government bonds, so they are able to use that as security to borrow money from other countries. Within the last 6 months, they have already borrowed $40 billion from overseas, and they still have room to borrow a little more. But in Chinese government-related investment funds, for instance, there is hardly any foreign currency left. In the past, Chinese government-related investment funds were named amongst the largest stockholders of Japanese companies, but not any more. There are many indicators that they have long sold off $5 trillion worth of Japanese company stocks.

Bankruptcy Will Be Followed By A South China Sea Conflict, Or If Not…

Q. If China’s economy collapses, is there a possibility that they will resort to international military action?

M: That is very possible.

Q. Are the countries around the South China Sea their potential prime targets?

M: Yes, most probably Vietnam and Taiwan. Then Japan’s Senkaku Islands. I am currently most worried about the border of Myanmar, as it is the area that is most ‘ablaze’.

Q. Is there not a civil conflict within Myanmar?

M: An ethnic minority, who were hired by England back when Myanmar was a colony, is effecting an anti-government movement. When this minority runs out of money, they receive money and weapons from China to continue their anti-government riots. We just have to wait and see what happens next.

In addition, China has constructed 2 aircraft runways with another one soon to be completed on 3 manmade islands in the South China Sea, including the Spratly and Parasol Islands currently having a dispute with the Philippines. Once the third runway is completed, there will be a high possibility of its leading to war.