Biden’s ‘Overregulation’ Haunts the US

An Interview with Dr. Arthur B. Laffer

The Liberty interviewed with Dr. Arthur B. Laffer, the father of supply-side economics, on regulation.

Interviewer: Hanako Cho

Hanako Cho: Today I wanted to ask you about regulations.

Dr. Arthur B. Laffer: I want to tell you upfront, this is not my specialty area. Now, I have worked in the area of regulations and it’s a very complicated area. It’s a loosely formed area for economics. In other words, the principles are not like they are for taxation.

Taxation is very easily quantified and put into form. [Regulations] are specific to an industry, to a time, to a place. There’s a regulation in Japan that you must drive on the left side of the road. We’re on the right side of the road [in the US]. You have all sorts of other regulations as to transparency. I’m going to try to touch on sort of the principles on regulations.

Regulations usually come from what we call externalities. Let’s say you have a big factory that puts out smoke, and that smoke falls on the people and supposedly causes diseases and bad living conditions so they put on regulations as to the type of smoke and the carbon content you can emit. Meanwhile, there are other regulations that supposedly help with positive externalities. It’s lovely having a farm; everyone benefits from clean air and animals so we subsidize farms and regulate that you can’t sell property. There’s one that’s being proposed right now and it’s that the Chinese should not be allowed to own any farmland or property near a military base. All of these regulations come with specific purposes at hand.

Cho: Thank you. To begin with, how do you define regulation?

Dr. Laffer: I would define regulation just where there’s a market dysfunction. This is the theory where there’s something wrong with the market and it’s a government coming in as a way of rectifying that wrong.

For example, monopoly. When there’s a monopoly, we all know that companies in their natural course of events will charge too much and produce too little compared to the competitive solution with a monopoly. So the government comes in and tries to put in regulations as to the return on capital or the price they’re allowed to charge or whatever it may be to manipulate that monopoly market into behaving more like a competitive market.

Another example are water companies. You can have a regulation on a water company where you can only make so much profit, and you must do this and that. Or you can have government control of the water company. In general, I would much prefer the regulation of the water company rather than the government monopolizing the water company. But those are both attempts to regulate a market, an industry, a company, a consumer into making the outcome more like competitive markets.

Cho: You once told me about the Laffer’s wedge to review regulation.

Dr. Laffer: Yeah, the Laffer wedge, which was coined way back in the beginning of time when Adam and Eve were still very young.

There’s a difference between the behavior of the producer and the consumer. What you do is you put on a tax or a regulation that drives a wedge between the price that the consumer pays and the price that the producer receives. The difference is that wedge. So it can be a tax wedge or a regulatory wedge. A tax wedge raises the price the consumer pays, and it lowers the price the producer receives.

A Good Regulator Will Utilize Incentives

Cho: Your economics puts weight on incentives. Could you explain the relationship between incentives and regulation?

Dr. Laffer: Let me give you an example. I’m very much of a conservationist, involved in wildlife and animals and all. I’m a tree hugger. I planted probably 70,000 trees on my own property. But the private sector has never been used properly with regard to conservation, and it should be.

In Africa, one of the family of Leakey in Kenya is trying to prohibit poachers from killing elephants. The poachers kill the elephants and then cut the tusks out and leave the dead body of the elephant sitting there. When he came in as head of the environment there in Kenya, he found all of these elephant tusks there so he had a big bonfire where he burned all the elephant tusks.

This is a sign of someone who’s just a stupid regulator. What you should do with all of those elephant tusks is to flood the market with them, bring down the price of tusks dramatically, make it illegal. Bring down the price of tusks so it’s not worth it for poachers to go in and kill elephants. You make the price so low and use the proceeds to hire guards to protect the elephants. That’s what a good regulator would do. But no, they don’t think economically.

Incentive can even be used to save endangered species.

Once upon a time, there was a rare, endangered bird called a forest fowl that is now the most plentiful bird on the face of the earth. It’s now called a chicken. Why are there so many chickens? Because they’re profitable to grow.

Sometimes, by allowing market prices to go high and making it worthwhile for people to have them, you can even eliminate endangered species. You subsidize the market and create more of them. This is a reverse wedge.

Having a market price on one of these is a way for people to produce them.

They had a bounty on rats in New York City. Because there were so many rats that they wanted to get rid of, like all the rats living in basements and in the garbage cans, they paid people if they brought in a tail or a head of a rat. They made the price so high that people grew rats in their basements as a business. Far from getting less rats, they got many more rats because people produced the rats.

The same thing happened with cobras in India. You want to use regulations with incentives, not against incentives.

Japan and the Barrier of Entry for Foreign Capital

Cho: Going back to your comment on the government stepping in so that a monopoly can behave more like a competitive market, what’s your take on Japan’s regulations that prevent companies like Uber and Lyft from entering Japan?

Dr. Laffer: What’s happening is taxicabs are trying to protect their industry by using government as a tool to prohibit competition. And that’s not what the government should be doing. Government should never be the agency of monopoly.

Taxicab companies, limousine companies and driver service companies should adapt to this new model. They should be the leaders of the change, not the people fighting it. It’s the same for Airbnb. Regulations have been used to thwart competition and economic growth, and those regulations should be stopped.

Cho: How do you see the reality in Japan where individual freedom of choice is less prioritized out of concern for safety?

Dr. Laffer: What you want to do conceptually is, “My actions should be free so long as they don’t interfere with you.” It should be perfectly legal as long as there’s disclosures. You make all the disclosures you possibly can.

I don’t know how to get the incentives for politicians to deregulate. What we have done, and we don’t want to do, is make companies have divisions of their company to lobby government. They have their government relations department. They should be using all their power to compete in the marketplace, not to go lobby government to give them protections and favors.

What you see now happening, and it’s big in Japan, it’s big in the United States, is these companies all have government relations departments specifically focused on, “How can we get favors from government?” rather than, “How can we compete and provide consumers with better products at lower prices?” They’re allocating their resources more towards government and less towards productivity, less towards better products.

I think we’re moving in the right direction in the US compared to the 1940s and 50s but God knows, we have a long way to go. But I think we’re making some progress. I mean, look at Tesla. Look at Uber. Look at Lyft. Look at some of these things on the internet. I don’t even understand. As you know, I have a flip phone. But I mean, it’s just amazing the productivity growth that we’ve had through technology.

America’s Deregulation Over the Years

Dr. Laffer: We’ve had some major changes in regulations over the years. I’ll give you a couple of examples. In 1974, we had regulations where people who bought stock had to pay 34 cents of commission on that stock trade. If you bought a dollar’s worth of stock, you had to pay $1.34. This led to a very dysfunctional stock market. In 1974, this regulation was terminated. Today, you can buy a share of stock for less than a penny in commission. All of these companies that lived on these commissions disappeared and now we have one of the most efficient stock markets in the world.

The Civil Aeronautics Board and the Federal Aviation Association had regulations on what companies and airlines could charge for their first class flights. This was under Jimmy Carter. Now, it was under Jimmy Carter that they got rid of all those regulations.

The price of airline travel dropped dramatically, safety increased enormously, and all of a sudden, airplane traffic became accessible to everyday Americans. They no longer competed by having caviar and champagne. They competed on price.

We have the same thing regarding trucking and shipping in the U.S., again under Jimmy Carter. They deregulated trucking and now, you can see that the trucking industry is extraordinarily efficient in the U.S. They’re competitive and freights are much lower.

There are a couple of other ones that have happened historically that are huge, Hanako. We had it so that it was illegal to sell any product produced by a company below its manufacturer’s suggested retail price. In other words, if an automobile company made a car, all the auto dealers had to sell that car at the same price. They could not lower the price. It was illegal to have discount houses, discount stores that would sell products below the manufacturer’s suggested retail price. We got rid of those regulations. Today, you can see the Walmarts, the Costcos, all of these wonderful companies selling products below a manufacturer’s suggested retail price. We have a much more competitive market, and it has endured enormously to the benefit of consumers and producers as well.

We had blue laws with the most famous one being that it was illegal to sell liquor on Sunday because that’s God’s day. All these blue laws are almost all gone by the wayside. We have a much more efficient market there.

We’re doing one right now in realtors. To buy and sell a house, there is an official commission that you have to pay the real estate agency so they do not compete on price. Now we are getting rid of real estate commissions – legal, enforceable real estate commissions. We have discount brokers where if you want to sell your house, you can go to someone who charges you less, which makes perfect sense.

And today, you can get a video of the house on your computer. You can have someone walking through it, showing everything there. You don’t need to go there; you don’t need realtors to be there. Realtors don’t need to charge 6%. I mean, on a million-dollar home, $60,000 is a lot of money to pay a realtor for buying and selling a house.

That’s one area that’s being done. There are other areas that are going into competition as well, and there are other areas that are going out of competition. A lot of it’s being driven by government monopolies, government bureaucracies, government agencies going rogue. They’re just not doing what they should do.

Overregulation Invites Governmental Control Over the Economy

Dr. Laffer: Now, we all know we need regulation. But regulations have grown in many ways into agencies, commissions, departments, where the regulators have taken control of a market and are not providing the efficiencies that they’re supposed to provide. They’ve gone out of control on overregulation. It has led to a lot of trouble here in the US.

For example, energy regulation. There is a very good argument that can be made that fossil fuels do add carbon when burnt. That does lead to global warming into force. A lot of people believe this is true, and it may very well be true. So Biden issued an order to cancel a pipeline project called Keystone XL which was a US-Canada oil pipeline. The costs of these regulations have way exceeded any possible benefits they could have.

In the first place, the production of hydrocarbons is very different than the burning of hydrocarbons. The US is the most single efficient producer of hydrocarbons. If you’re going to have hydrocarbons, they should be produced in the US rather than in Venezuela or other places. But [the government] put production regulations on American companies so even though the same amount is being burned, it’s now just coming from much dirtier sources. This is some of the real problems of regulations.

Here’s where we have a huge political schism between the Democrats and the Republicans, between Joe Biden and Donald Trump. Donald Trump wants to see the US be the most efficient producer of hydrocarbons in the world, and Joe Biden wants to stop it. I think Trump is correct in this case.

Something that Al Gore and I agreed upon many years ago is that there should be a tax on hydrocarbons. Maybe a gas tax. Maybe a coal tax. But the problem with the tax on hydrocarbons is that it will lead to a collapse in the economy. This economy does not need more taxes. Believe me when I tell you that.

So we agreed upon having a tax on hydrocarbons, let’s say a gas tax, but we would reduce the income tax or the payroll tax by the exact same amount as the hydrocarbon tax. There would be no net tax. We’ve been trying to get it into the Senate, but no senator will agree to it, either Republican or Democrat. They just won’t. It’d be much better to lower income taxes and payroll taxes and offset that lowering of those taxes by increasing carbon taxes. But this is the way I would do it rather than all the regulations.

I think that would have a huge impact on the cleanliness of the air. And I think it would be very positive for economic growth.

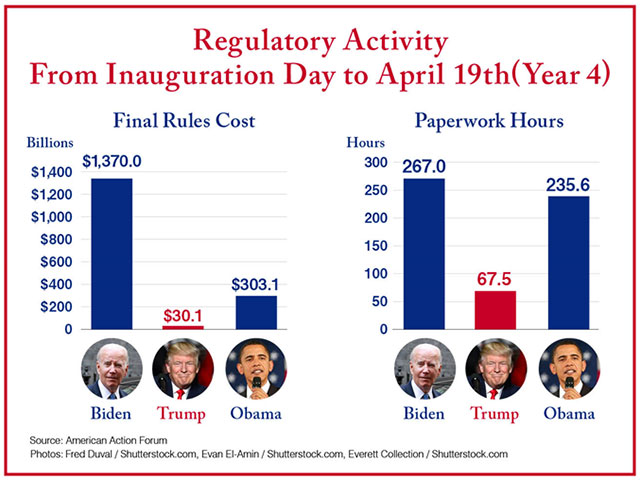

Cho: According to Unleash Prosperity Hotline, President Biden is on track to impose more regulatory costs on the US economy than any other president in history, adding $1.37 trillion. How does this affect the US economy?

Dr. Laffer: Well, it affects it very badly. Biden and the whole administration and Congress have emphasized the commissions, the regulatory bodies, and given them complete power over the market with no recourse whatsoever. That has led to excessive regulations.

We need regulations that are specifically focused on the problem at hand. You want to make sure that these regulations don’t go beyond the specific purpose at hand and create a lot of collateral damage. What [the Biden administration] has done on these regulations is they’ve gone way beyond the specific purposes at hand, and they have created a lot of economic damage. Biden wants to increase those regulations to gain control over the economy by government.

Government’s role should not be to get as much control as it can over the economy. Their role should be to have the right level of control and to know when to stop regulating, know when they should regulate, and to represent the people rather than being an independent force in the economy.

In my book, Eureka, I mention that there are 258 separate commissions in California. This is based on laws dated from the 1860s that have no relevance whatsoever today. I stopped at that number but there are a lot more than this that are self-perpetuating commissions with staffs. They cost a lot of money and are permanently funded by taxpayer dollars. And there’s no oversight of these commissions. There’s no sunset provision. I would make it so that every law has a sunset and that you have to reaffirm that law every 10, 15, 20 years to make sure that it’s still relevant.

Regulators should be balanced between consumers and producers and the economy. They should not be all for consumers. They should not be all for manufacturers. They should try to do a balance. They should look at healthcare concerns along with productivity concerns and balance everything. Otherwise, they’ll shut the world down.

Cho: Could you tell me about Trump’s deregulation achievement?

Dr. Laffer: Trump has been very good on regulatory policies in general. He’s been reducing regulations, picking the worst regulations and getting rid of them, and using only the most necessary policies for putting in new regulations. I think he promised to get rid of two rules for every one new rule he puts in. (Editor’s note: The Trump administration actually eliminated 22 regulations for every one that has been added.)

He also did the executive order to require hospitals and healthcare providers to disclose prices and qualities of products so that people can make honest-to-God, good economic choices. Let me give you a background on the healthcare industry of the United States.

Now, healthcare is something like 20% of US GDP. In the U.S., I think the average life expectancy is something like five years less than the average in the OECD. I believe that if we could get price transparency in healthcare and make it mandatory as a regulation, you must post your prices. Those prices must be available to people who come in with cash and say, “I want to buy that operation.”

I have done that myself a lot, by the way, that I’ve gone into a hospital and negotiated a price. I can save a lot of money doing that. I believe if this were uniform and used in the U.S., we could increase life expectancy by two years. We could reduce the cost of GDP by 10%. You have a totally dysfunctional system and that totally dysfunctional system has led to a huge reduction in output.

It used to be that people paid for their own healthcare. You went to your doctor, you went to get a checkup and you paid your doctor. If you were poor, your doctor was very kind and didn’t charge you much. If you were rich, you paid a little bit more. Because you paid for it, you didn’t want to overuse your healthcare because, frankly, it cost you money. The doctor wanted to be there to provide, so he made money from your paying. It worked like any product in the marketplace.

As years went on, healthcare, they thought, became more and more important and therefore should not be subjected to market forces. So therefore, we got insurance that would cover people for their healthcare.

What happened was that people lost sight of what the healthcare cost. Doctors lost sight of what the healthcare cost and what they received. There was this intermediary that created a huge monopoly on healthcare through insurance. When you go to your doctor, you know you have healthcare insurance on everything you’ve done, whether provided by the government or the private sector. So you don’t even ask what the price of something is. You just go in and say, “I’d like to have that.” Your doctor doesn’t know what the cost is. That has led to enormous, and I mean enormous, misallocation of resources. It’s led to huge waste.

For example, the US life expectancy relative to the rest of the OECD has, over the last 50 years, dropped considerably. We’re now way below the OECD on life expectancy as a measure of healthcare consequences. As a cost, as a share of GDP, US healthcare has increased relative to the OECD. We are spending huge amounts more than other OECD countries, and we’re getting much worse results because of the mismatch between costs and prices.

The people don’t know what they’re buying. They’re just told, “You need a CAT scan,” or you need something like that and you go out and get it. You send the bill to your healthcare. It’s led to an enormous inefficiency in the marketplace. We’re trying to require healthcare providers to list the prices they actually collect on healthcare services so that consumers know what it costs and what they could buy it for, and what they could get it for through their insurance.

What we shockingly find, Hanako, is that the same hospital, the same procedure, the same day, everything kept the same, but depending upon the different insurance policies, the prices will vary by a factor of three or four or five. One insurance company will pay 6,000, and the other insurance will pay 1,000. In other words, if you went into a grocery store, and you bought an apple, you would pay five times as much as someone else in the grocery store.

What we need to do is have markets so that they’re competitive, so we have the same price. There’s a huge amount of misinformation. Again, I think we’d save maybe 10% of GDP just on healthcare costs and the outcomes would be a lot better. That is a huge improvement in the U.S.

Going back to Trump, Donald Trump put in an executive order while he was President that mandated that hospitals disclose the prices they actually collect on healthcare services but the penalties were very small for breaking the penalties so it’s not been implemented well. But he did that. He gave me credit for it by the way in the Roosevelt Room.

Trump also did a wonderful job on deregulating energy. He understands the business. He understands the pollution. He understands all of the arguments much more so than Biden does. I think that in the second term for Trump, which I think will happen, he will be really good on regulations and make the world a better place.

Labor Regulations Will Hurt Once the Economy Starts Sinking

Cho: One very big concerning issue for the Japanese economy is labor regulation, which is about lifetime employment and seniority system. Do you think these laws also constitute regulations?

Dr. Laffer: I like it where you treat old people really nicely. But no, you shouldn’t have lifetime employment. Employment should be a contract between the employer and the employee with certain safeguards, of course. But it should be a contract there where both parties are allowed to continue the contract for as long as both parties want to. It should not be guaranteed there by age or seniority. I think it should be based upon productivity and merit.

Now, these rules and these regulations during periods of strong economic growth don’t do much damage. But when you have slow growth and slowdown in the economy, they do a lot of damage.

I used to be on the council for Governor Arnold Schwarzenegger along with Milton Friedman, George Schultz, Mike Boskin, Dave Taylor, all of these famous economists. When I was on this council, I told him I was leaving because I didn’t like what he was doing. I told him that his latest rules were all wrong and that I wanted to leave. His one question was, “Arthur, do you think raising the minimum wage hurts the economy?” Which is a regulation. I said:

“Yes, but it probably won’t hurt it right now because we’re in a boom. But I’ll tell you when the economy starts sinking and you don’t have a tight labor market, that minimum wage will hurt the poor, the minorities, the disenfranchised, Black Americans, young Americans, less educated Americans, and it is the wrong way to go. You should not have a minimum wage. You should provide for economic growth and help people who are in bad circumstances. But it should not be a minimum wage. You should not put a regulation on an employer that he or she must pay a certain amount to an employee because what are you going to do when there’s a loose labor market? You’re going to not hire those people who need the jobs the most and who would love to work for less money, but they can’t because it’s illegal. And that’s just the wrong thing to do.”

In other words, the minimum wage is an anti-capitalist regulation. It’s clearly a regulation that hurts the poor. We still need to work hard to keep the government from gobbling up all of the private sector.