An Interview With Dr. Laffer: Japan’s Economy Will Not Recover With Lower Yen and Trade Protectionism (Part 1)

The Liberty had an opportunity to interview Dr. Arthur B. Laffer, the father of supply-side economics, regarding Japan’s looming inflation.

(Interviewer: Hanako Cho)

Cho: Today, Japan is facing inflation and currency devaluation. How do you think this will play out?

Dr. Laffer: I’m going to do three roles with you today – one as an economic commentator, another one as a prognosticator or a forecaster, and one is going to be a teacher.

Let’s go back a step and let’s talk about currencies. There are two things that have to do with currencies. One is the dollar value of a foreign currency, or the foreign currency value of a U.S. dollar, either way. There’s something called “the law of one price.” If a store is selling apples and another store is selling apples next door, you better guess that the prices of the apples will be very close. When there’s a lot of trade, and demand and supply can shift, prices arbitrage. Therefore, in the global economy, if all prices arbitrage, the price level in Japan times the dollar value of the yen should equal the price level in the U.S. Now, a lot of differences are transportation costs and composition of that. But bottom line, prices should arbitrage – especially easily traded prices like petroleum.

With that in mind, if the price level in Japan times the dollar price of the yen equals the price level in the U.S., what happens if the dollar price of the yen changes? Let’s say it goes from 118 to 147 [yen per dollar], which is exactly what has happened. What would you expect to happen to inflation?

You’d expect U.S. prices to fall relative to Japanese prices. Now, what you don’t know is whether US prices fall or Japanese prices rise. But the relative movement is the law of one price.

The second principle is the Sydney Alexander absorption approach. If, in fact, there is a huge investment boom in Japan so that everyone wants to move their capital into Japan, you would expect the price differences in goods to change in Japan so that Japan becomes less competitive, all right? The U.S. sells more to Japan, buys less from Japan and real resources move into Japan to take advantage of, let’s say, lower taxes.

You have the law of one price there which is offset 100% by inflation. Then you have the absorption approach, which is offset by a change in terms of trade. These are two very different but very powerful concepts in today’s economy.

Unfortunately, Japan’s Inflation Rate Will Keep Climbing

Cho: The Japanese yen is depreciating as import prices are rising.

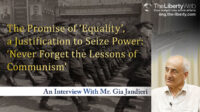

Dr. Laffer: Here is the inflation chart from the first quarter of 2012. As you can see, as the yen starts depreciating, look at how those inflations in U.S., the Eurozone, U.K. and Canada compact together (refer to chart 1).

I would argue that the correspondence between changes in the Japanese yen exchange rate with the Eurozone, the U.K. pound, the U.S. dollar and the Canadian dollar is a classic representation. Japan’s inflation rate is rising relative to the rest of the world, and the rest of the world’s inflation rate is shrinking relative to Japan.

Why does this happen?

Japan as a country is desperately involved with the gains from trade. You don’t have millions of miles of farmland. You’re a small island and you have to be specialized. You don’t have all the oil in the world. The gains from trade for small countries or isolated countries are much more important than they are for other countries. It can’t change the terms of trade, which is the Sydney Alexander absorption approach. In that case, import prices will keep rising. When the cost of trade goes up, there will be a trade deficit and foreign countries will be left with a lot of yen on their hands. But since foreigners don’t use the yen, they would sell it to purchase more U.S. dollars. This is why the yen starts depreciating.

If it continues, I would expect to see Japanese inflation rates continue to rise relative to the rest of the world as it absorbs inflation in. That’s my prognostication. It’s the law of one price.

Bullseye! Currency Devaluation Invites Inflation

Cho: Could you tell me more about the issues of an economic policy that favors currency devaluation?

Dr. Laffer: I wrote a Wall Street Journal paper in 1974 called ”The Bitter Fruits of Devaluation” which explains the exchange rates and the price levels. At that time, the U.S. under the Nixon administration had just devalued the dollar. Paul Volcker and I argued at that time that the U.S. was going to be in for a big round of inflation while everyone else, Milton Friedman, Paul Samuelson and all the great economists said I was crazy – that fiscal policy did not warrant the inflation, monetary policy didn’t warrant the inflation or regulations didn’t warrant the inflation. But I argued that devaluation would lead to U.S. prices rising relative to the rest of the world, and that part of the world would be in U.S. inflation. I think within a year, a year and a half, we were at double-digit inflation.

The Essence of Trade Lies in the Demand for Imports

Cho: Japan has long been an export-oriented country and the Japanese people perceive that a strong yen is not beneficial to our country. How should we view the Japanese people’s preferred sense of a weak yen?

Dr. Laffer: It really isn’t the Japanese people. It’s the government. It’s the Diet. It’s everything in the politics of Japan. They want a weak currency to export more. They want to depreciate the yen. And finally, they’ve been able to do it. They’ve gotten the monetary authority, the Bank of Japan, which has finally conceded and accommodated the devaluation of the yen.

In 1973, I wrote a WSJ paper called, “Do Devaluations Help Trade?” Let me use that article to answer your question.

Pull back for a second with me. Why do countries export? Why do you work? Most people work – they like their job and all that, don’t get me wrong – to get paid. Why do you like getting paid? Because you like to buy things. You go work at a job so you can earn income so you can buy things. So the supply of work effort is really the demand for goods and services.

Now, why does a country export? Why would you give other countries your goods?

Cho: Because they want to earn money?

Dr. Laffer: Why do you want to earn money?

Cho: They want to become rich.

Dr. Laffer: And you also want to buy goods from them. I want to sell goods to Japan so I can buy goods from Japan. The exports of Japan and the proceeds you earn from those are to be used to buy goods from abroad. Now, why do you want to buy foreign goods as opposed to Japanese goods? Why not just buy goods from yourself?

Because they’re different goods, alright? It’s very hard to buy bananas in Minnesota in the winter; you’ve got to buy bananas from Costa Rica or South America. We sell goods to South America so that we can buy bananas from South Africa – we get the bananas which we never could get, and they get the goods they never could get. This is David Ricardo’s comparative advantage.

We sell goods to foreigners that we make more efficiently than they do, and we buy goods from foreigners because they make those goods more efficiently than we do.

When you ask yourself, “Why do we sell goods to them? Is it because we like them?” no, it’s because we want to earn the foreign currency so we can buy those goods that they produce that we really want to do that. The supply of exports is the demand for imports.

Tariffs and Protectionism Damage Both Exports and Imports Alike

Dr. Laffer: Now, if I tell you, “You’re not allowed to export anymore,” what will it also tell you? Not only will your exports go down, but so will your imports go down. This is what’s called Lerner’s symmetry theorem – that a tax on exports is the same thing as a tax on imports, and both exports and imports will drop commensurately. A subsidy on exports is the exact same thing as a subsidy on imports. So when Japan puts taxes or tariffs on imported goods, they are also putting a tax on export goods. Now, if anyone believed that a tax, or a tariff, on imports hurt exports, do you think they’d do it?

Cho: No, they wouldn’t.

Dr. Laffer: They just don’t understand economics, Hanako. Lerner’s symmetry says that the supply of exports is the demand for imports. If you prohibit people from buying imports, they’ll stop exporting. If you prohibit them from exporting, they’ll stop importing, alright? And anything that impedes the free trade will hurt both exports and imports.

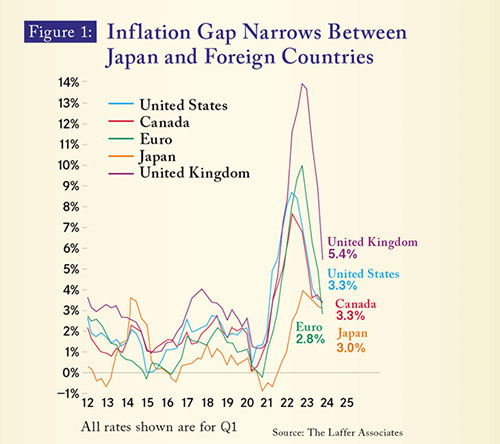

This chart (chart 2) is the Lerner’s symmetry theory in data. It shows that you export in order to import, in other words, the supply of exports is the demand for imports. It shows the imports and exports as a share of GDP for OECD countries. The horizontal axis is exports as a share of GDP and the vertical axis is imports as a share of GDP. Now, imports equal exports almost exactly. All the countries are just the same.

So when Japan tries to encourage exports, the exports increase but the imports increase just the same amount. Why would you sell more to foreign countries if you don’t want to buy more from foreign countries? Japan has a foolish perspective on trade, thinking that exports are good and imports are bad. Imports are the reason people export.

Cho: Wow, I actually didn’t know this.

Dr. Laffer: This is the only reason a country ever exports – to be able to import. And why would I sell you my goods unless I could buy your goods? Why would I work for you unless I could get paid by you? It’s the same thing. It’s really simple once you see it.

The Japanese Diet does not see it. The Japanese government does not see it. They’ve got all of these protectionist measures trying to stop imports. You can’t get a U.S. car in there; it’s really expensive to get a car authorized. That is what Trump tried to do with the tariffs, bringing down tariffs across the world. But the reason, very simply, is Japan’s taxes on imports does hurt the U.S., but it also hurts Japan because a tax on imports is the same thing as a tax on exports. They’re the exact same policy.

Tariffs Cut Free Trade: The Result was the Great Depression and WWII

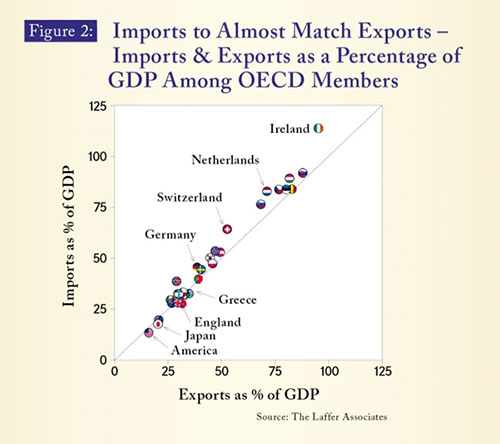

Dr. Laffer: I’m going to show you what damage can happen when this occurs. In my paper, “Taxes Caused the Great Depression” (chart 3), you can see the Smoot-Hawley tariff which was passed through the Senate in 1929 and then the House in 1930. It was signed into law in June of 1930 – a huge tax increase. We were very protectionist then like Japan, so we bid a huge increase in import tariffs.

You can see exactly what happened when the Smoot-Hawley tariff was enacted. Unemployment boomed. The stock market collapsed. It killed the economy. The highest personal income tax. They needed revenue, and they raised taxes. They caused the Great Depression. I’m going to make one other argument here, which is from Mundell. Not only did the Smoot-Hawley tariff cause the Great Depression, but it also caused World War II.

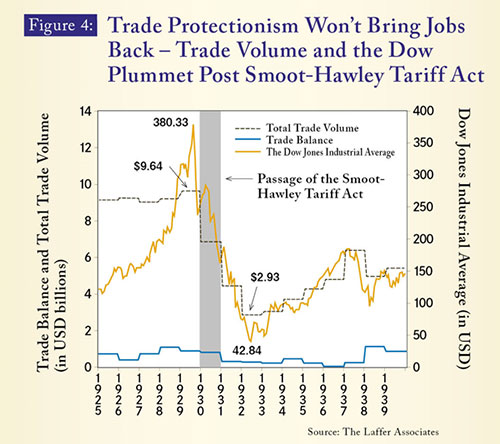

Now, look at another chart (“Protectionism Doesn’t Bring Jobs Back”, chart 4) that shows the relationship between the Down Jones Industrial Average and trade balance of goods.

Here you can see the Smoot-Hawley tariff is the gray. Everyone knew it was going to be passed in late 1929, and you can see the stock market get to a peak of $380.33 towards the end of 1929 and went down to $42.84 in October 1929. It fell by 90% from $380.33 at its peak. Total trade, exports plus imports, went way down from $9.64 billion to $2.93 billion. It shrank by two-thirds, alright? And the trade balance never changed because of Lerner’s symmetry theorem.

This is what happens when you have huge protectionist measures put in your country. I could use all sorts of other data with you, but nothing is more powerful than when the U.S. was protectionist in late 1929 and 1930. That led to the Great Depression, and that led to World War II. My view, which is Mundell’s view in his Nobel Laureate lecture, is that this is a direct sequence of cause and effect.