Wealth Tax Will Cause ‘Huge Reduction in Wealth,’ Dr. Laffer Explains

An Interview with Dr. Arthur B. Laffer

Interviewer: Hanako Cho

Cho: The Biden administration has been pushing for the expiration of the Trump tax cuts. They are considering raising taxes on the wealthy, which they have pledged to do as a specific measure to avoid raising taxes on those earning less than $400,000 a year.

Dr. Arthur B. Laffer: Let’s talk about the general picture from 30,000 feet. I’m going to be very broad in my discussion of the government here because there are a lot of issues, complexities, and other sources of confusion. We use words that have many meanings. For example, the word “taxes” often is confused with “tax rates” versus “tax revenues.” Tax revenues and tax rates have a strange relationship with each other, even though they are most frequently conflated as the same.

The Three Primary Functions of Government: Collection, Spend and Volume

Dr. Laffer: There are three primary functions of government fiscal policy at a very high level. Number one, it matters how government collects its revenues. Number two, it matters how government spends those proceeds. Lastly, it matters what the level of government spending and taxation is.

For government taxation, the North Star would be to have the lowest possible tax rate on the broadest possible tax base. I’m repeating myself a lot from previous discussions we’ve had but forgive me. By having the lowest possible tax rates people are having the lowest provided the least incentive to evade, avoid or otherwise not report taxable income. And, by having the broadest tax base, people are provided with the least number of places where they can put their income in order to avoid paying taxes.

There are some exceptions to that. For example, there are some purposes of taxation that are not specifically focused on revenues. What we call sin taxes on alcohol, tobacco, firearms, as well as fines and fees. The reason we have those taxes is to get people to stop doing it. The reason we tax speeders on the freeways is not so much to collect revenues as it gets them to slow down when they drive and to drive more safely. We tax cigarettes not to get the revenue so much as it is to get people to stop smoking because it kills them.

This is sort of the general position of taxation. There is almost no reason or logic underlying any type of tax credits, tax expenditures, tax omissions, tax deductions, tax write-offs, tax exclusions. All of those don’t make any sense in the grand scheme of taxation. They really don’t. You want to use taxation exclusively for the purpose of raising revenues.

Now, do you want to consider any type of relationship between taxes and government spending? The answer there is literally no, unless there’s a direct link between cost and benefit. If you have the government ownership of a store, the government should charge the purchaser of products the exact same as a private company would charge the purchasers of private products. If the government is going to own businesses, which they do own some businesses and some people argue they should own those businesses, how should they run those businesses? They should run those businesses just like a private company would run those businesses.

That includes water, electricity, liquor stores. It includes all sorts of other things and businesses that the government runs. It also includes things like Social Security. How should the government run Social Security? Well, they should run the Social Security system as if it were a private Social Security system. In other words, the amount they take out of the employee’s pay should be exactly the right amount of a private account. If the employee had a private account, what would be the amount that they would put in the private account to make sure they have this? This is generally the revenue issue for governments. How they collect their money matters.

There’s also another issue associated with taxation as an alternative revenue source where the government is borrowing. If there is a reason for having more production today and less production tomorrow, then you want to fund the government primarily through deficits today and surpluses tomorrow. A deficit gives an employee today a bond, a claim on the income from future production when they sell the bond in the future. During war times, governments often run big deficits because that increases the production during the wartime and as a consequence reduces the production later on. It changes the timing of production in the system.

#1: How Government Collects Revenues Matters

Dr. Laffer: How government collects its revenues really does matter, and it matters a lot. In the broadest possible verbiage on my part, government wants to collect its revenues in the least damaging fashion and spend its money in the most beneficial fashion. There is no reason why you should ever lock a revenue with an expenditure unless that revenue and that expenditure combined are the best combination for the economy.

Now that’s why I say, if the government runs a private business, it should sell those products at the marginal cost and that’s the price they should charge. They should pay their employees competitive market wages. They should run it as if they were a private, profit-maximizing company. The same thing is true with regard to regulations. If they’re regulating a public utility or highways, fines and fees, jurisdiction systems and soldiers in the military, they should use those same principles of the private sector.

Without detailed knowledge of specific factors of production, the best tax system would be the lowest rate on the broadest possible base. It really is the least damaging to the economy. Then there’s the exception of sin taxes that I talked about to get people to stop using those things.

The issue of deductions, exemptions, exclusions, credits and all of this stuff is it’s not appropriate to use a penalty system (i.e. taxes) to positively reward people for doing things.

Let’s take aid for dependent mothers. Here is a mother who’s got a child or two children, she doesn’t earn very much money, and we want to supplement her income to make her life better. In that case, you should always write her a check, not give her a tax deduction on her taxes. The first reason is, very simply, that the tax deduction changes incentives. The second reason is that she may not file a tax return. If she doesn’t file a tax return, you’re not helping her by giving her a tax credit or a tax deduction or a tax omission.

The last thing on the use of credits, deductions, emissions or write-offs is that the cost of these tax credits and filings are extraordinarily high. They require a lot of enforcement. We assume that people understand and obey the laws completely but that’s not true. People do the best they can, but frankly, it’s much more expensive using deductions, exclusions, credits, etc., than it is collecting your taxes once and for all and then writing a check to the person directly.

#2: Government Spending Has Consequences

Dr. Laffer: The second thing I want to talk about is government spending. Government spending also has consequences. If you pay people not to work, you’re going to incentivize them not to work.

You must understand that you want to have a system of taxation and of spending that is the most efficient, most pro-growth, the highest output, given the social objectives. In other words, if you want to help that mother with children or with dependent children, what are the requirements that you put on that woman? What are the conditions of that spending and how do they affect that person’s willingness to work?

If you tax people who work and you pay people who don’t work, you’re going to get a lot of people not working.

If you tax people who are healthy and you pay people who are unhealthy, you’re going to get more people who are unhealthy and less people who are healthy.

If you tax young people and give the money to old people, you’re going to change the behavior of old people and young people.

All of these things should be looked at in terms of incentives; the incentives matter. Economics is all about incentives.

#3: The Volumes of Taxation and Spending Matter

Dr. Laffer: Now, the third factor is the volume of taxation and volume of spending. How much you collect and how much you spend also matters.

Government spending is taxation. This is where we get to the “transfer theorem” that we’ve done 10 times together, but I’ll do it again with you. Government transfer payments reduce output. They reduce output from the taxpayers, and they reduce output from the transfer recipients.

If you take from those who have a little bit more, you’ll reduce their incentives to produce. And if you give to those who have a little bit less, you’ll also reduce their incentives to produce. You’ll provide them with income that they otherwise would not have had, which is the income effect, which means they’ll work less. Whenever you transfer resources, you always reduce total income. Always. The more you transfer resources, the greater will be the reduction in total income. Lastly, if you were able to create exact equality of income, if you made everyone come out the exact same, there will be no income whatsoever.

All of these are really important. Now, taking this as our background, you want government to produce the goods it should produce at the least cost. That’s the sort of general theory of the government.

By the way, this is not a field where people need opinions. I think that Van Gogh painting is pretty but someone else may not like it. That’s an opinion. I can’t stand tomatoes and some people like tomatoes. That’s an opinion. In economics, this is not about opinion. This is about facts, not what you feel. We have huge repositories of data on how people actually behave with taxation, with government spending, with the volume of it. I’ve done my whole life’s work on these facts in my book, “Taxes have consequences.”

I have asked to debate with Saez, with Piketty, with Sanshava, with Zucman, with all of these people, and they refuse to debate with me. I use their data because they produce their data very well. I reduce it and come to the exact opposite answers. When you look at that compared to my book, “Taxes Have Consequences,” with Dr. Jeanne Sinquefield and Dr. Brian Domitrovic, we use the same data.

Trump’s Tax Cuts Should Not Be Let to Expire

Dr. Laffer: When you look at what expiration occurs on the tax cuts, I don’t believe there’s an expiration of the corporate tax rate. I think the corporate tax rate stays at 21% forever. That portion does not expire at the end of 2025. What does expire is the personal income tax rate which will go from 37% back up to 39.6%. But the one that’s really big for me is the death tax, the inheritance tax, the estate tax. That goes way up at the end of 2025. The amount you can give tax-free goes way down and the tax rates go way up.

Two things happen on the death tax: the death tax rates go way up and the amounts you can give tax-free goes way down. I believe the death tax to be one of the most disgusting taxes that has ever been put on planet earth.

In the United States today, you can earn your income and pay your taxes fair and square. You can take the income that you’ve earned after tax and you can go to Las Vegas, drink and smoke, carouse with people of the night and gamble all activities which we frown on. But the government says that’s fine, it’s your money, you keep it. You can do with it as you want. But if you take that same money and give it to your children, they’re going to tax the living hell out of you. That is a disgusting, immoral, vulgar tax that has very little to say for it. It doesn’t collect much revenue at all.

The revenues it does collect are basically people who didn’t hire lawyers, accountants and deferred income specialists. They didn’t pay lobbyists off. They didn’t pay politicians off.

One of the biggest taxpayers on the death tax was when President John F. Kennedy’s son, John-John Kennedy, and his wife were flying up to his cousin’s wedding in Massachusetts. He had an airplane accident off the coast of New York on the flight there and he crashed into the ocean and killed himself. He died very young, before he had a plan to control his estate. Therefore, they just taxed the living hell out of his estate because he didn’t hire the lawyers and accountants and deferred income specialists. That’s just not the way we want to run a country. That’s not the way you want to run an economy. That’s why I am here.

The expiration of the Trump tax cuts make no sense whatsoever. The corporate tax rate reduction has had an enormous impact on the economy, even on Biden’s economy, and it’s all been positive. It has brought us to the lowest level of unemployment of minorities, Hispanics, African Americans, the less educated, the young, all of these people, the lowest poverty rate in the U.S. after this. The TCJA paid for itself. Total government revenues went up. Now, it is very true that corporate tax revenues went down. But other taxes made up for it, and now corporate tax revenues are way up above where they were. It’s been one of the best tax bills ever. Anyone who says it didn’t pay for itself, it didn’t work, it favored the rich, is lying. They just don’t know what they’re talking about.

We have all the evidence, all of the numbers on this. I would be more than happy to debate anyone on any issue there. It’s just facts, and that’s the truth. Bottom line, the Trump tax cuts should not be let to expire. They help the economy, and if Biden is reelected and they do come up for expiration, I think Biden should extend them. I doubt very much if he will. He doesn’t understand economics and he doesn’t have good economists working for him.

Wealth Tax is ‘Stealing’ and ‘Inefficient’

Cho: What does the wealth tax mean in the first place? It seems to me that capitalism cannot exist without the concentration of capital. What are your thoughts?

Dr. Laffer: When you have income and you pay your income tax, what’s left over is yours. It’s your money to do with as you see fit. With a sales tax, if you buy the product and you pay a sales tax, that product is 100% yours.

With a wealth tax, that is not true. With a wealth tax, you pay your tax this year but your wealth isn’t yours because you have to pay a tax on it again next year, then the year after that and the year after that. Once you pay your wealth tax, that just means you have it for one period, then you have to pay it again and again, all on the same wealth. Your wealth is never yours.

Now, we have a wealth tax in the United States – we have property taxes. If you live in a home, you have to pay property tax every year. That is a wealth tax. Now, with a property tax, like a wealth tax, when you pay it, it just gives you a period where you can use that without having to pay it again but then you have to pay it again next year and the year after. It has a very different effect, and it causes a huge reduction in the value of the wealth.

Wealth taxes are really inefficient, bad taxes. It should not be used. There are two reasons why. Number one, it’s because it’s never your wealth and so it affects the value of that wealth. But also, Hanako, there are no ways you can do things to get around paying the wealth. If you own a home, you can’t take it to another jurisdiction. You can’t consume it. You have to pay that tax and you can’t do anything to avoid that tax so you suffer that loss. If I have an income tax, I can hire a lawyer or an accountant or a deferred income specialist, or a favor-grabber or a lobbyist. I can change the timing of my income. I can change the location of my income. I can change the volume of my income. I can change the composition of my income. With the wealth tax, it is confiscation. It is stealing, pure and simple. Wealth taxes are extraordinarily bad, and they have enormously detrimental effects on property values and on the total amount of wealth.

Now, when you talk about capitalism, you’re correct. But when you look at taxes in the capitalist system, what you want is the lowest rate on the broadest base because it is the least damaging tax system available. But let’s say you found a less damaging system like with carbon tax, I’d prefer that tax to the low-rate, broad-based flat tax because you’re getting rid of a negative externality. If it’s because of global warming and you have it on the burning of carbon, I would prefer that tax.

In a capitalist system, you want to have the government collect the taxes in the least damaging fashion possible. That may include a tax on the returns to capital. You may want to have income from capital taxed at the same rate as income from labor. So I would not treat taxes any differently whether you’re in a capitalist system or not. If I were running a communist system, I’d like to do it in the least damaging fashion possible as well.

You don’t want to overtax capital. You don’t want to undertax capital. You want tax capital in the way that does the least damage to the overall economy.

Now, there are lots and lots of economists who disagree with what I just said. They believe that there is a special role for capital in an economy. They think there’s a Keynesian multiplier for investment and that if you put an investment of $600, that $600 investment will increase consumption by the marginal propensity to consume, and they’ll spend more of that. It’s called an exogenous expenditure and leads to a multiplier effect and increases the economy. I do not believe this model of economics is correct.

There are lots of people who want to give special advantages to capital. You hear all of these people want to do a consumption tax, not an income tax. The reason you earn income is to be able to consume. If I told you you could never consume something, why would you ever save if you could never spend anything you saved? Obviously, the whole reason for ever earning income is to consume. Now, you may not want to consume today. You may want to save today and then consume tomorrow. But there is no economic advantage by a broad-based consumption tax versus a broad-based income tax. In fact, I would argue that a broad-based income tax or value-added tax is preferable to a consumption tax, although both are pretty darn good as far as taxes go.

The Implications of Biden’s Potential Wealth Taxes

Cho: Of all the wealth taxes that the Biden administration is considering (i.e. raising the income tax rate for the wealthy above $400,000 from 37% to 39.6%, raising the capital gains tax rate for the wealthy above $1 million to 39.6%, imposing a minimum tax rate of 25% on households with at least $100 million in income which includes unrealized capital gains), which one appears to be the most problematic for you? Additionally, what do you see as the impact on the U.S. economy if the above policies are implemented?

Dr. Laffer: Raising the income tax rate from 37% to 39.6% makes no sense to me. It’s silly, it’s wrong and I don’t think they’ll get the money from it. It will hurt the economy, okay? You need to have a low-rate, broad-based, flat tax.

The next one they have here, raising the capital gains tax and the wealthy to 39.6%, is really damaging because people can change the timing of their capital gains. If you had a broad-based, proper tax, increases in unrealized capital gains should be taxed but there should be no capital gains tax after that. That’s the way it should be done. But raising the capital gains tax for the wealthy over $1 million to 39.6% is very, very ill-conceived. It’s bad to do.

But now, the one I want to talk to you here that gets tricky is to impose a minimum tax of 25% on households with at least $100 million in income, which includes unrealized capital gains.

Now, let me just be very verbally precise. Increases in unrealized capital gains are income. With the bill I did for Jerry Brown, unrealized capital gains would be taxable at a low, flat tax rate but once it’s taxed, unrealized capital gains is never taxed again. Let’s say you have unrealized capital gains that go up $10 this year. That increases the base, and next year you can’t tax that same $10. If it goes up again, you can. If it goes down, you get to deduct it. But [realized] capital gains is not taxed; increases in [unrealized] capital gains are taxed, and reductions in [unrealized] capital gains are deducted. That wording is extremely important. So if he were to impose a tax on increases in unrealized capital gains and offset it by some other tax cut, I think that might be a good thing. But 25% is way too much.

The Case of Warren Buffett: Income Tax Rates Can Be Deceiving

Cho: The issue is sometimes raised that Mr. Buffett and others pay less taxes than their secretaries. In response to this criticism, Mr. Buffet himself has proposed a stronger taxation of the wealthy. What are your thoughts on this issue?

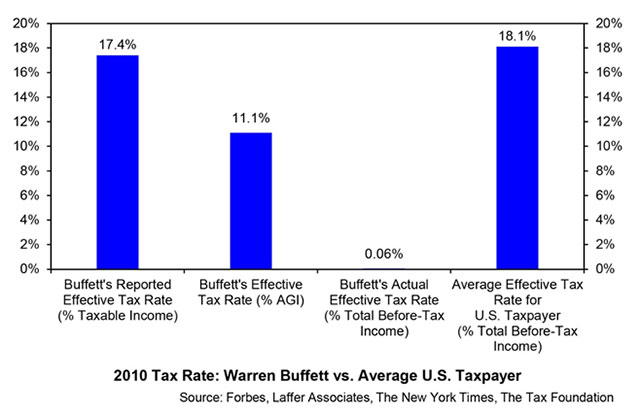

Dr. Laffer: Warren Buffet wrote a letter to the NY Times in 2011 in which he reported his income for the year 2010. I really admire Warren Buffet enormously. He’s a phenomenal investor. He’s very pro-American, very pro-business and he has a big heart. He is doing all he can in my mind to make the world a better place but that doesn’t mean he’s right. Now, what he tried to do in this letter is to make you shocked by the facts – and they are shocking. He wrote in the letter to the NY Times that his income tax rate on his total income in 2010 was 17.4%.

He said he paid $6.9 million in taxes and his tax bill was 17.4% of his taxable income. He said that of the 20 or so people in his office, that was the lowest tax of anyone in his office. All the others had a higher tax bill than he did, which he thinks was wrong.

Now, I looked at his tax bill and looked at that percentage. He did not report the taxable income but if he paid 17.4% of his income in taxes and his taxes were $6.9 million, the taxable income would be $39.8 million.

We also know that there’s a deduction from the adjusted gross income to the taxable income. You’re allowed to deduct 30% of your write-offs there if you give to charities and all that. You can reduce your adjusted gross income by 30%.

So I was able to take his taxable income, $39.8 million, and I divided it by 0.7 to get his adjusted gross income of $62.9 million. Now, he did not put that number in his letter. That is just how I calculated it. So he paid $6.9 million in taxes. He had $39.6 million in taxable income, and he had $62.9 million in adjusted gross income.

You’ve got those numbers in front of you in your mind. Now, in economics, we use a special definition of income, the Haig-Simons definition of income, which is conceptually the correct definition. “What did you spend during the year? What did you give away during the year? And what was your increase in wealth?” That is your income during a year.

Now, I looked at Warren Buffett that year and I looked at how much he spent on himself. Supposedly, Warren Buffett doesn’t spend a lot of money on himself. He eats hamburgers at McDonald’s. He drives an old car. He doesn’t live in a fancy house. He’s not a fancy person. He really isn’t. So I said he didn’t spend anything.

I then looked at how much he gave away. During that year, Warren Buffett gave away a lot of money to the Bill and Melinda Gates Foundation. I went to the Bill and Melinda Gates Foundation and looked at how much he gave to the Foundation. I think it was about $1.6 billion, maybe a little less, that year he gave to the Bill and Melinda Gates Foundation. He has two sons who also operate 501(c)(3)s. He gave to them. He has a wife that has a foundation. He gave to her. And he has a daughter who has a foundation. He gave to her as well. Now, I don’t know how much he gave to the two sons or to the daughter or to the wife. It really doesn’t matter. I’m sure it was not small, but I do know that he gave about $1.6 billion to the Bill and Melinda Gates Foundation.

Then, number three, what was the increase in his wealth in that year 2010? I went to the Forbes magazine site for the wealth of the wealthiest people. Now, he owns almost all of his wealth in a company called Berkshire Hathaway. Berkshire Hathaway is traded on the stock exchanges so we know what the stock price is. We can figure out how much he made from December 31, 2009, to December 31, 2010. That number comes up to approximately $10 billion. That was the increase in the unrealized capital gains that year. When you look at it, say he spent $0, gave away $1.6 billion which I know is more than that, how much his wealth went up was $10 billion. I take the sum total of that, the Haig-Simons definition of his income, and his income was $11.6 billion that year. If you look at what he actually paid in taxes, if you take the $6.9 million he paid in taxes and divide it by his true income, which was $11.6 billion, that comes out to a tax rate of six one-hundredths of 1% of his income.

So when he says he paid 17.4%, he’s not being correct. Now, should he pay higher taxes? Yes, he should. We should have a low-rate, broad-based, flat tax where he would pay taxes on his unrealized capital gains and never tax them again. If his unrealized capital gains goes down, that should be a deduction or refund from previous years. That’s how the taxes should be done. This is the tax bill I did with Jerry Brown.

That is not what he actually pays in taxes. Then he argues to raise tax rates. My comment for him on raising taxes is that he raises taxes he doesn’t pay, and doesn’t talk about taxes that he should pay. He should talk about tax reform, not about raising tax rates. I’m not saying that he’s a bad man. He just doesn’t know economics as well as I do. If he understood the economics, I’m sure he would agree with me.

A Wealth Tax Won’t Raise Government Revenue

Cho: The introduction of a wealth tax may be justified from the perspective of revenue maximization. Treasury Secretary Janet Yellen said that extending all expiring measures of the TCJA is a serious concern from a budget deficit perspective. Is a wealth tax justified in that way?

Dr. Laffer: She’s just misguided. A wealth tax would not raise revenues. It would cause a huge reduction in wealth. We should not get rid of the TCJA because that tax more than paid for itself. [Yellen] would lose money and it would cause the deficit to expand.

This is a classic case. She has the skills, she has the training, she has the understanding to know better. But because she is a government employee, she has an obligation, an oath of fealty, to support her boss. When you work for Liberty, you would not do anything that would hurt Liberty. Would you? Of course you wouldn’t. You’re an employee. You wouldn’t do anything that would hurt liberty because as an employee, you have an oath of loyalty to your employer.

She also has an oath of loyalty to her employer, Joe Biden, who is the President of the United States. When he makes an argument, her job is to defend his position, not tell you what is exactly accurate. I’m going to say this bluntly but let me say it. These people will rebut arguments they know to be true in order to curry favors with their political benefactors.

Now, I hope that in private she tells him the truth. But in public, she should not sit there and say her president is wrong. I stand her position. And this is why I made a vow after being in government in the Nixon administration. I made a vow I would never ever work for government again. I did not work for Ronald Reagan. I was very influential but he couldn’t raise my pay. He couldn’t cut my pay. He couldn’t hire me. He couldn’t fire me. I did not work for him. So I could always tell him what I thought.

Now, I loved Ronald Reagan and I would never undermine someone I give advice to. But I think the worst thing I could ever do, Hanako, would be to give advice that I didn’t think was true. That doesn’t mean my advice is right. I’m wrong a lot of the time and I don’t mean to be. But I never try to be wrong, and I never tell a politician something that I believe is wrong. When you work for government, you’ve got to tell the public things that you know are wrong because it supports your president and you don’t want to undercut him.

The Counterargument to Saez and Zachman: ‘A Rising Tide Raises All Boats’

Cho: Emmanuel Saez and Gabriel Zachman, in their co-authored book, “The Triumph of Injustice,” argue that the maximum income tax rate should be at a level close to 100%. What would happen to the economy if such a thing was implemented?

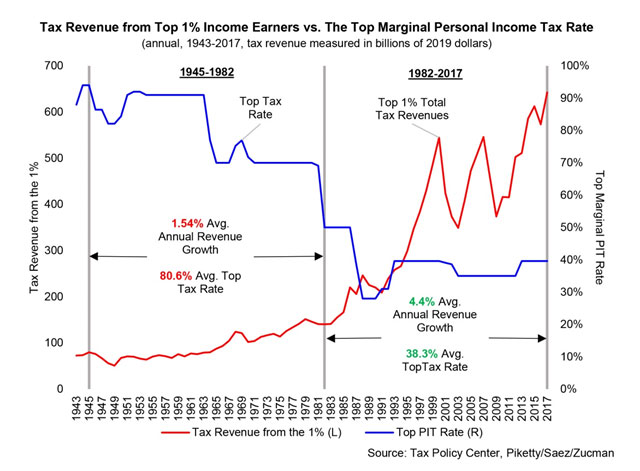

Dr. Laffer: Every single time we’ve raised tax rates on the rich, the economy has underperformed and the poor have been hurt [the worst]. Every single time we have cut tax rates on the rich – the top 1% – tax revenues have gone up, the economy has outperformed, and everyone has been made better off, including the poor, the lowest group in society. Now, if that’s an argument for raising tax rates on the rich, I’ll be damned if I’m an economist.

I don’t understand Saez and Zucman and all of these other people and what they are talking about. They throw facts out as if we [don’t] have the answers. They know what happens when you raise tax rates on the rich but they don’t say it. It’s from their data that I get those answers: I use their data in my book. So these are the same numbers they produce and they do at their center, but they don’t tell it. Silence to hide the truth is a lie, and they are remaining silent on what happens when they raise the highest margin tax rate to protect their answer.

What would you like to have in a tax system? We all live in countries with a lot of people and we have a social contract with all those other people. I have a contract with all my fellow Americans that they abide by the laws. We agree not to always agree and that we put our differences up to a vote. We will accept the results of a democracy, of a republic. These are all things of a social compact. I’ll argue on a situation on taxes and other people will argue differently, and that’s why we have elections. If I lose the election, I’ll live within the system. I won’t go out and be a revolutionary or anything. What this should be is that you and I and all the others in this social compact should work to make each other better off. We’re all in the same boat if you will and John F. Kennedy put it beautifully. He said that no American is ever made better off by pulling a fellow American down. And we are all made better off if any one of us is made better off. The next line he used in his speech is, “A rising tide raises all boats.”

Meanness, viciousness, vindictiveness, isms all over the place – ageisms, sexisms, racisms, regionalisms – where we hate people from a different group are wrong. We are all in this tub together. The old and the young, the male and the females, the black and the white, the Asian and the American, the Hispanic, we’re all in this tub called an American tub. What we try to do is love our fellow citizens. Our dream is to not exploit one group to favor another group. That’s not right. We need a system whereby we all voluntarily abide in the rules and the regulations and the elections of this system. It’s because they’re my brother and sisters. They’re my fathers. They’re my mothers. They’re my daughters. We’re all one people.

So when you look at taxes, when you say that rich people are bad people, you are not living within the contracts of a society. There is nothing wrong with being rich, Hanako. There’s something very wrong with being poor. The dream in our country should not be to make the rich poor. The dream should be to make the poor rich. The dream should be to raise the poor, not to hurt the rich.

If Blacks in the United States, African Americans are not doing well, the dream is to make opportunities and prosperity for African Americans to be better; not to make whites worse. To make males worse, to make females better is not right. What you want to do is to give females more opportunity, not give males less opportunity.

Privilege is not wrong. There’s nothing wrong with privilege. The only thing wrong is that everyone should have privilege. Everyone should be treated special in the system. It shouldn’t be that you should take away privilege from people. You should provide privilege to people who are not privileged. Always balance up. Never, ever, ever balance down.

To hate that group and say I’m going to tax them is deeply wrong and disturbing to humans. I want a tax system that the rich people think is fair too. The rich people are not like fatted calves. Did you go out and slaughter them and eat what they produced? No. Rich people are good people just like other people are good people. The dream is to make the poor people richer, not to make the rich people poorer.

The Tax System Should Be Fair and Agreed Upon in a Democratic Process

Dr. Laffer: What we need to do is have a tax system that the taxpayers and the tax recipients, the spenders, all basically agree with. Yes, there are going to be people who cheat on the system. There are welfare recipients who cheat on the amount of welfare they get. There are taxpayers who cheat on their taxes and all that. But the reason you have a low rate broad-based flat tax system is because it is fair. Rich people understand they have to pay taxes. They understand they have to pay their fair share of taxes. But when you tax them too much and they think it’s unfair, then they’re going to use all the power they have with all their wealth to avoid paying taxes. It’s going to be a war. And they’re going to win.

So you want to have a low rate. You want taxation to basically be voluntary. I know I’m rich. I know I make a lot of money. I’m willing to pay 12% or 13% of my income but I’m not willing to pay 90%. It’s wrong and unfair. What should the top income tax rate be? That should be the fair tax rate. That should be the one that does the most production for the U.S. society. That’s the one that benefits the poor the most. That is the one that creates the most prosperity for all Americans.

Then you have the spending programs to take care of how much government should produce of this, that or the other, and have some redistribution. You shouldn’t let some people fall dead on the street; you need a good safety net to help some people in society. But that’s how it should be done. Taxes should be done “voluntarily.” By voluntarily, I mean that the rich should basically agree with this in the democratic process of voting. And everyone thinks a low-rate, broad-based flat tax is fair. If you make 10 times as much as I do, you should pay 10 times as much in taxes as I do, but not 100 times as much.

Cho: In the paper entitled, “Vis Medicatrix Naturae,” you noted the following: “In other words, I believe reducing inequality by elevating the poor is the right thing to do, while reducing inequality by inhibiting the wealthy is the Devil’s mission.” As you have previously discussed, hostility to capitalism is on the rise in the U.S. There is even talk of the wealthy having a monopoly on democracy. What is your view on these myths and what would happen to the U.S. economy if these kinds of thoughts became major public opinion?

Dr. Laffer:You cannot eliminate inequality in a society. You can’t. Some people are born short; some are tall. Some people are born with congenital diseases that we haven’t found cures for yet. I’m very sorry for them. Some people die of a heart attack at 37. I mean, lots of things happen. The government cannot correct for all of these things.

If you want to read a volume that says it all, there’s a short story by Kurt Vonnegut called Harrison Bergeron. It will bring home [that] there are limits to what government can and cannot do. What the government should do is what Teddy Roosevelt said in his famous speech.

The government should make sure that there is no endemic discrimination for or against the rich, for or against the poor, for or against the tall. And it’s [on] the government to make sure that the game is fair, that the cards are not stacked against anyone. [The government] cannot change the distribution of income. But what it can do is change the volume of income. Its role should be to make the game of cards fair and make the game of life fair, …to make sure that no one gets to exploit someone else, …[to prohibit] negative things in society.