Six Months after the Brexit Referendum

Were Brexit Opponents Correct in Warning about the Possibility of Economic Crisis?

About six months has passed since the national referendum on the UK leaving the EU. The British government will give an official notification to EU no later than the end of March of 2017 and start ratification procedures with the remaining EU 27 member nations. A final deal on Brexit could be reached by October of 2018.

Meanwhile, there is a concern about the fate of the post-Brexit British economy. Before the EU referendum, those in support of the UK staying in EU said that Brexit would lead to 6 % drop in the UK GDP, putting over 3.3 million jobs at risk, and that the UK would lose access to EU markets, dissuading international companies from coming to the country. Some critics were concerned that Brexit would cause an economic crisis greater than the Financial Crisis of 2008. Have the British economic conditions gotten worse like Brexit opponents insisted? Let us think about this through various economic indicators.

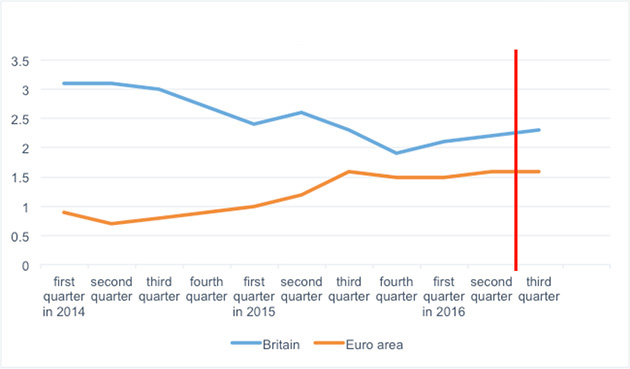

No drop can be seen in the British economic growth rate

The UK racked up an annualized growth rate of 2.3 % (preliminary figure) in the third quarter (the July-September quarter) of 2016. Considering that the GDP growth rate in the Euro Area in the same period was 1.6%, it can be said that the British economic conditions are good.

No Drop in British economic growth rate

(The red vertical line shows the time of the EU referendum. The editors of Liberty compiled the graph based on the statistics that Eurostat and the Office for National Statistics (ONS) provide. )

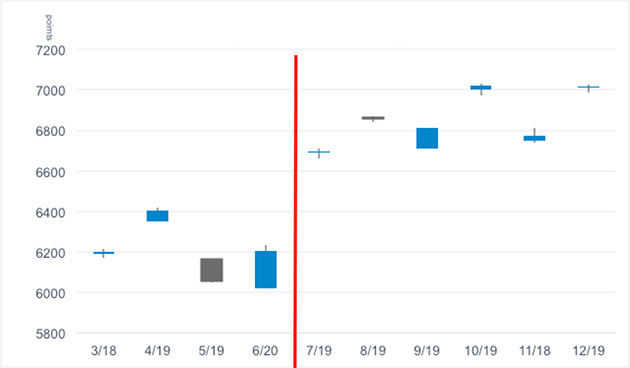

Share prices are on the rise

Next, let us take a look at the FTSE 100 Index, a share index of the 100 companies listed on the London Stock Exchange. The index before the pre-Brexit vote was around 6,000 points, but it rose above the 7,000-point level after the vote. This shows that investors are confident about the bright future of the British economy.

The UK stock prices are on the rise hitting an all-time high.

(The red vertical line shows the time of EU referendum.)

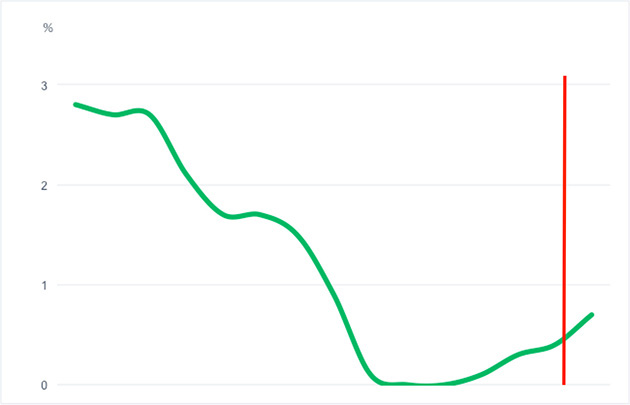

Consumption is gradually recovering

The Consumer Price Index, a measure of the average changes in the prices of consumer goods and services, shows that the British economy is on a gradual recovery trend. The index of the previous year dropped to nearly 0%, prompting fears of the British economy going into deflation. But the UK has started to shift into inflation since the beginning of this year and the trend has still continued.

The UK consumer price index is on an inflationary trend

(The vertical red line shows the time of the EU referendum. The editors of The Liberty compiled the graph based on the statistics that ONS provides)

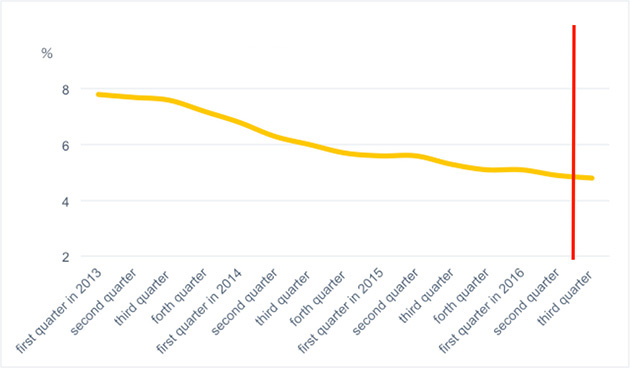

The unemployment rate is declining

The Britain’s unemployment rate continues to decline to 4.8% in the third quarter of 2016, which is lower than Germany jobless rate of 6%.

The UK unemployment rate is on the decline.

(The red vertical line shows the time of the EU referendum. The editors of The Liberty compiled the graph based on the statistics that ONS provides)

Judging from these economic indicators, the British economy is picking up rather than being thrown into turmoil triggered by the vote for Brexit. Before the EU referendum, British politicians, as well as the media, had fueled the people’s fears with scary scenarios. However, the economic trend after the EU referendum shows that Brexit is the right choice for Britain. It can be said that the UK is in a position to be able to show the future after the break-up of the European Union.

![The Laws of Justice: How We Can Solve World Conflicts and Bring Peace [Kindle Edition] by Ryuho Okawa/Buy from amazon.com](/files/2017/01/170114_amazon.jpg)